The Webomindapps team has done a fantastic job on our website revamp. They really took their time to understand our insurtech domain and transformed our complex website content into a simple, intuitive, and visually stunning website. Their attention to detail is remarkable, which is evident in their performance-focused development and consistent collaboration throughout the project. The execution was highly efficient, and we are truly happy with how our website now looks, as it aligns well with our brand innovation!

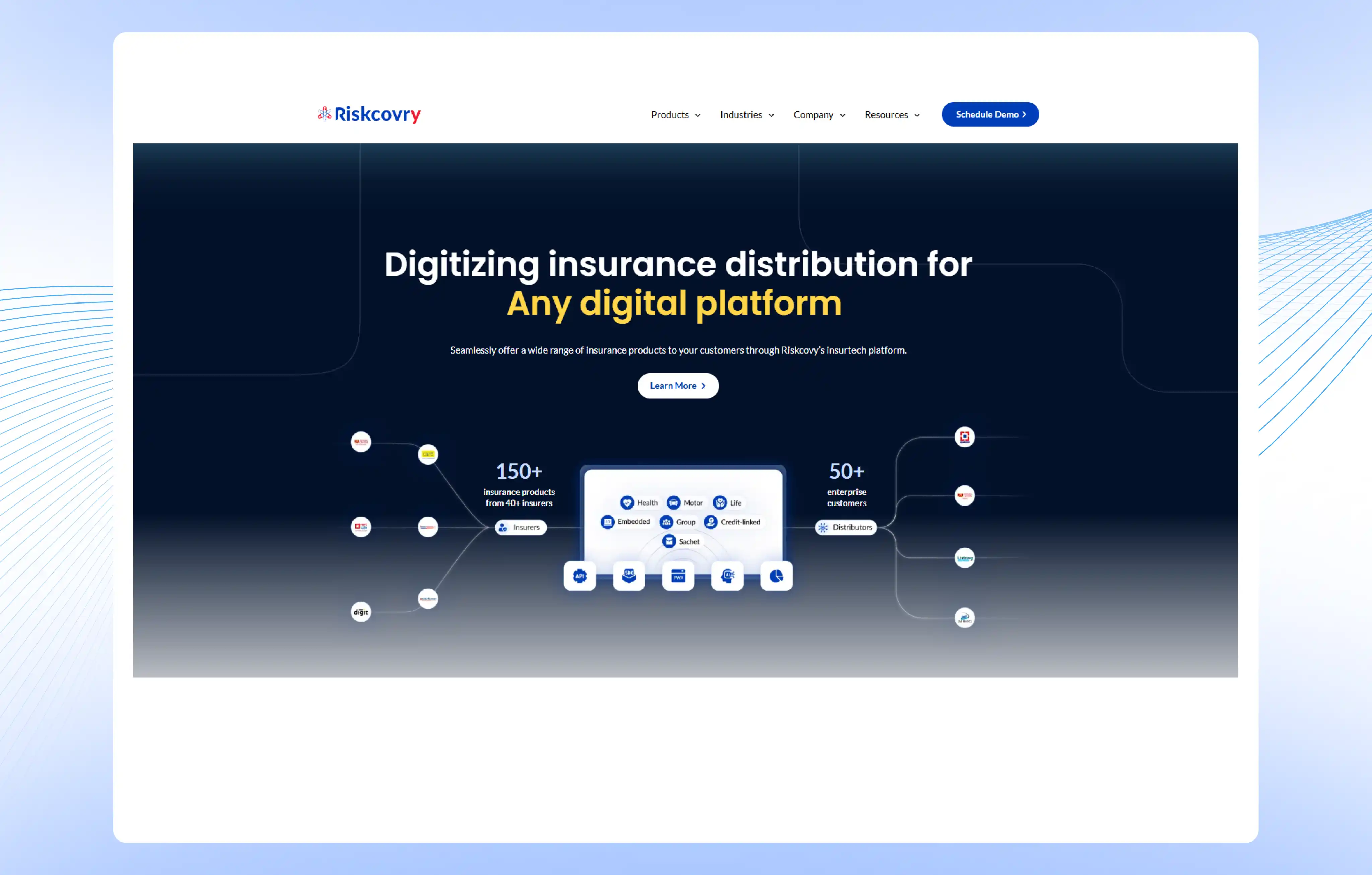

Turning insurtech complexity into clarity

through smart web development for Riskcovry

Brand Overview

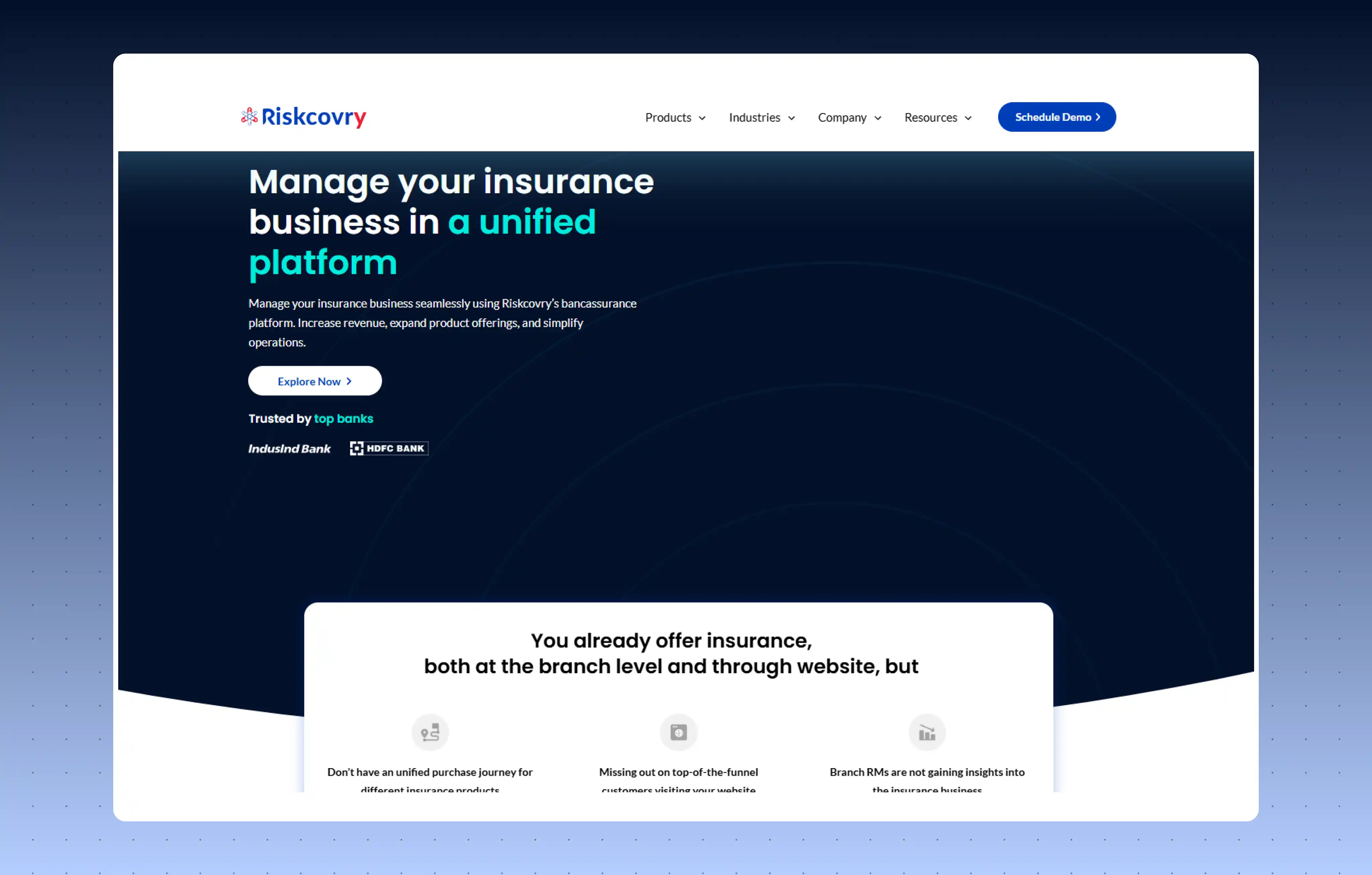

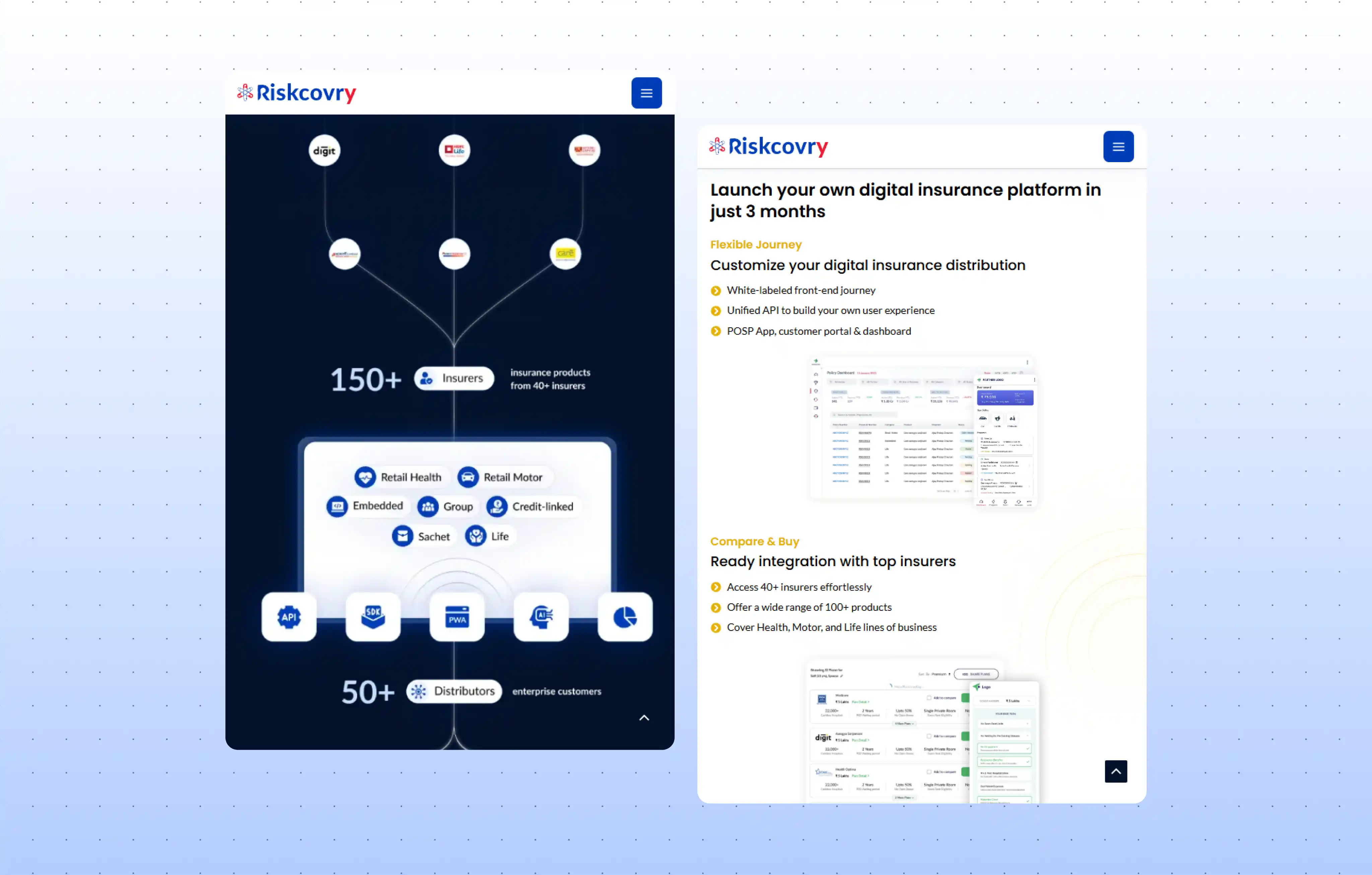

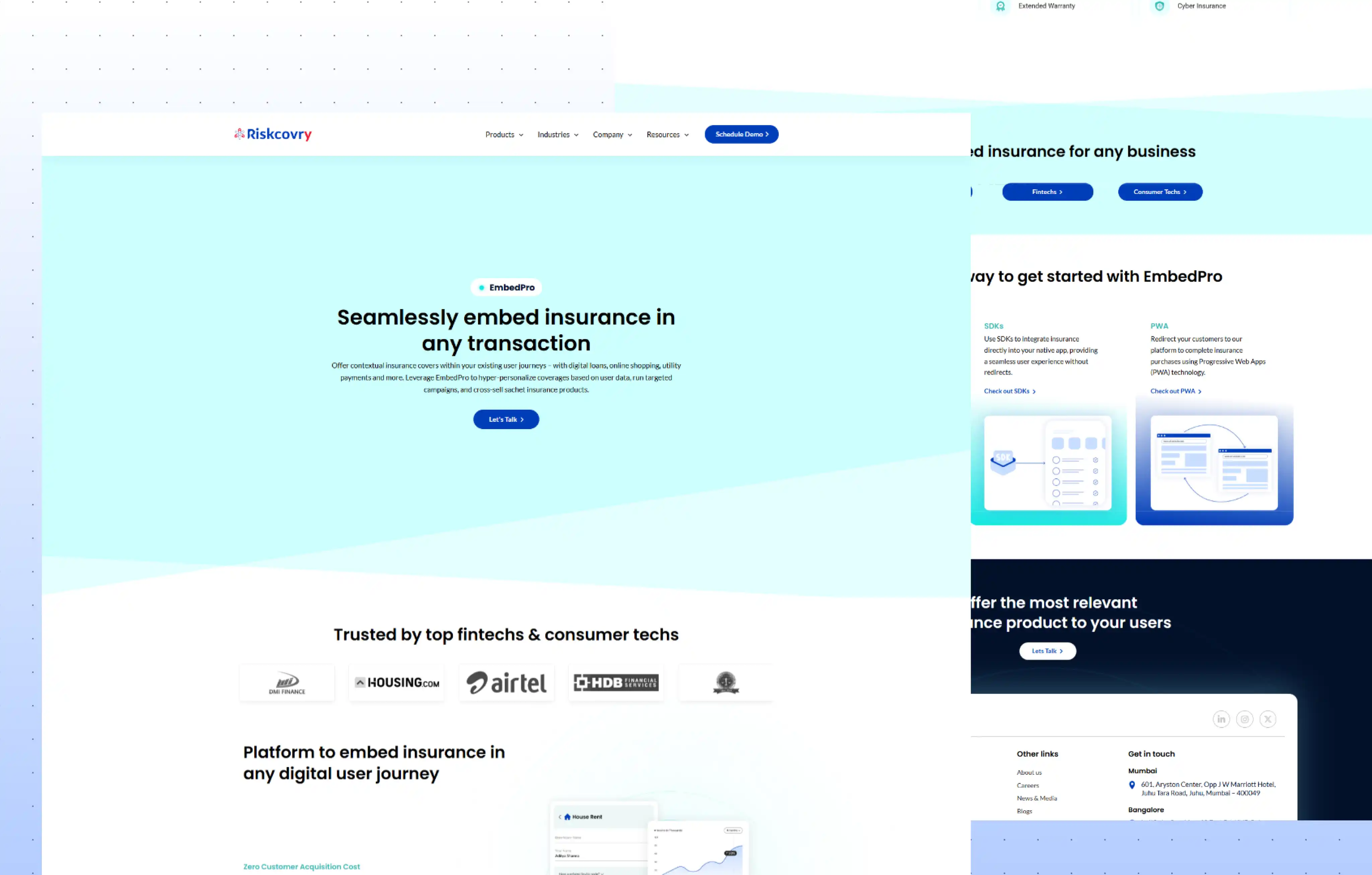

Riskcovry is an insurtech (insurance and technology) digital platform that enables other banks, NBFCs, brokers, and lenders to distribute insurance products. There are 4 types: LendPro, RetailPro, EmbedPro, and Console.

These are designed to transform insurance processes from traditional paperwork to seamless digital distribution. They mainly aim to embed, distribute, manage, and automate insurance products via digital means.

The

Challenges

Lack of understanding the niche: There was limited knowledge regarding their fintech/insurtech industry, which made it difficult for us to structure and present Riskcovry’s complex product offerings.

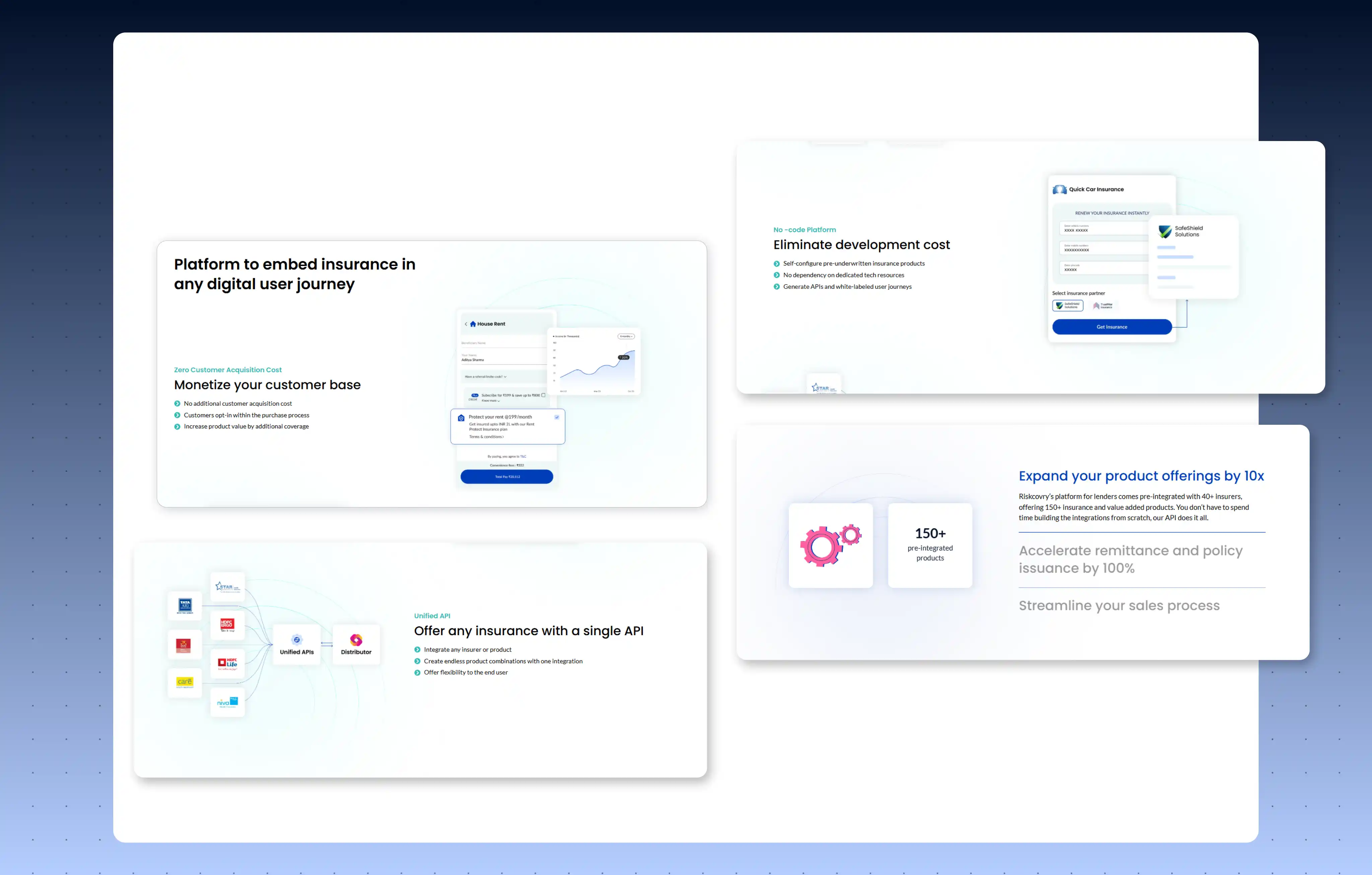

Displaying product information: The products involved dashboards, APIs, and multi-layered solutions that couldn’t just be explained with plain text. Visual representation through graphics, dashboards, and interactive design was necessary to make them understandable.

Animation and speed: The need was to integrate engaging animations, GIFs, and Lottie files while maintaining fast load times and smooth performance across devices.

Riskcovry wanted a modern, responsive website to showcase their insurtech products with a smooth user experience.

Riskcovry is an insurtech digital platform that works as an insurance distributor for other businesses, such as lenders, banks, NBFCs, etc. Our key challenge was to understand their niche, which is fintech, specifically insurtech.

This made it difficult to design their website, where we had to represent their insurance products in a way that is easy to understand. Additionally, the website had to work seamlessly across all devices without creating a separate mobile version.

The

Approach

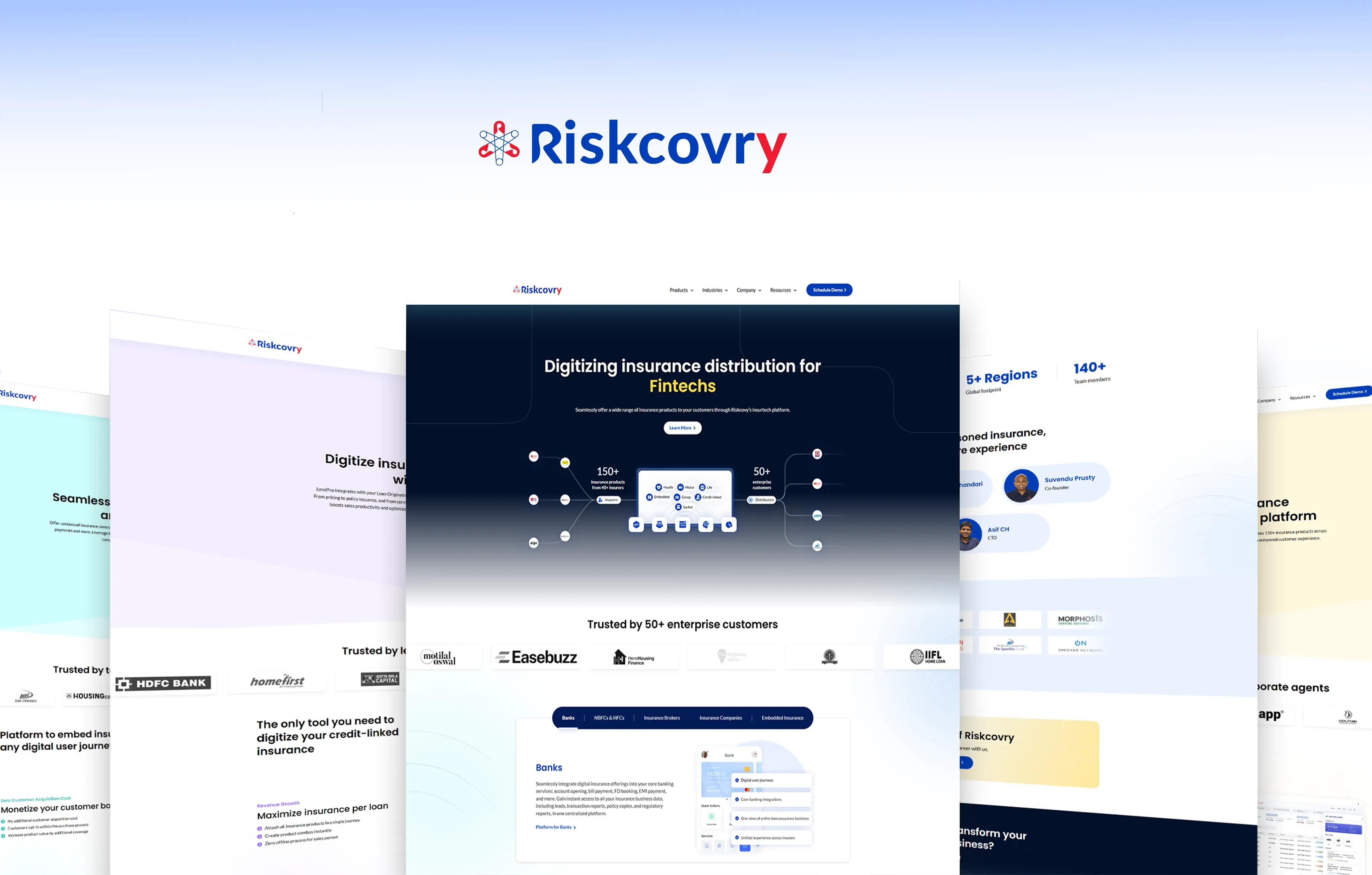

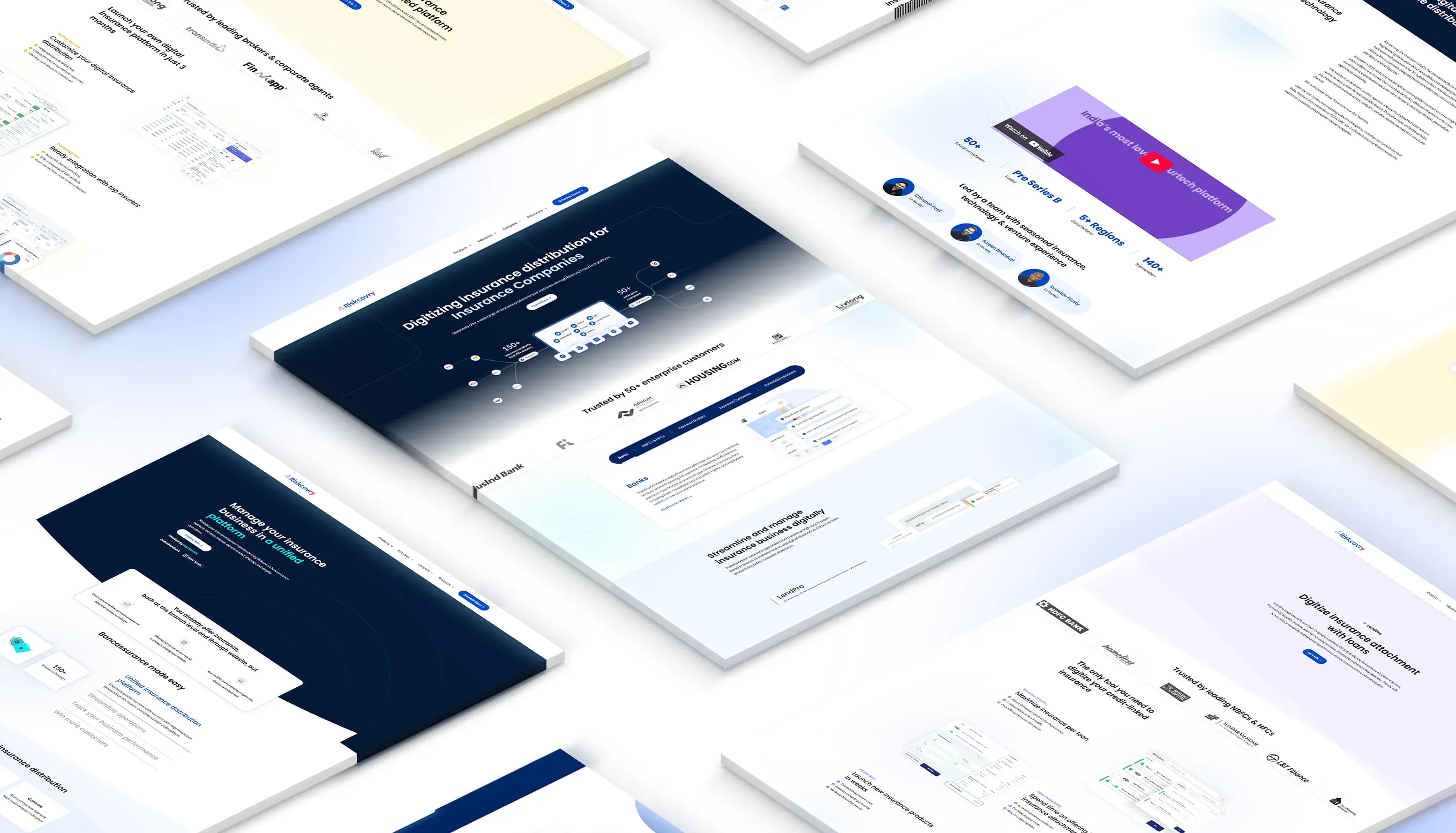

Our dedicated team of web design and development experts collaborated internally to understand the niche by researching fintech. With the industry knowledge acquired, they came up with sketches, animations, and mock-ups inspired by other fintech company websites.

Thus, we successfully developed a sleek website for Riskcovry that resulted in a seamless user experience and better customer engagement. The improved creatives enabled better representation of their product.

The

Solutions

- We studied top fintech/insurtech websites and created design mocks, validating each step with the Riskcovry tech team for accuracy.

- We transformed complex offerings into simple, brand-centric creatives using product sketches, GIFs, Lottiefiles, and refined graphics.

- We added carousels, dashboards, and multilingual options, balancing animations with optimized performance for smooth speed.

- We followed a mobile-first approach and created separate designs for desktop, ensuring a seamless experience across all platforms.

- Each page was refined to feature a fluid container layout for smaller screens while utilizing a more expansive design for larger displays, optimizing user experience across devices.

The

Impact

The redesigned website showcases Riskcovry’s modern, tech-first identity as a leading insurtech company. Complex products are explained clearly and engagingly through visuals, animations, and interactive features.

The site is optimized for speed and responsiveness across all devices, creating a seamless experience that builds stronger trust and interaction with users.